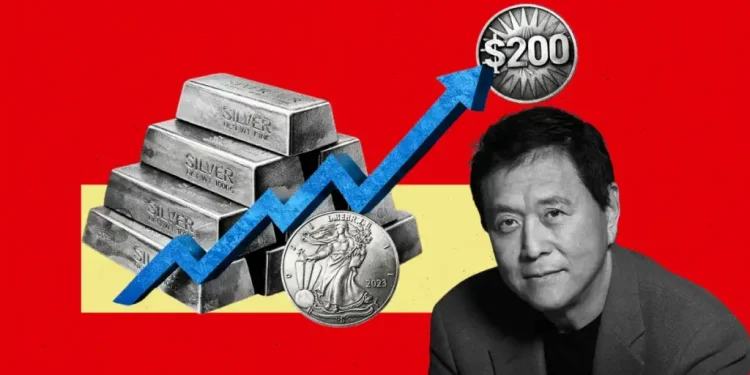

The post Rich Dad Poor Dad Author Explains Why Silver Could 2x From Current Highs appeared first on Coinpedia Fintech News

Rich Dad Poor Dad author Robert Kiyosaki believes silver will reach $200 per ounce in 2026. In a post today, Kiyosaki called silver the “structural metal” of the modern economy and said its role in technology makes it more valuable than gold.

The prediction comes as silver hit a record high of $95.89, now up 31% year-to-date. The metal is approaching $100 for the first time.

Why Kiyosaki Thinks Silver Beats Gold

Kiyosaki’s argument is simple: Gold sits in vaults while Silver gets used.

Silver is found in electronics, solar panels, electric vehicles, medical devices, and military equipment. Unlike gold, much of it is consumed and difficult to recycle.

“In today’s Technology Age, silver is elevated into an economic structural metal, much like iron was the structural metal of the Industrial Age,” Kiyosaki wrote.

He pointed to silver’s price history. In 1990, it traded around $5 per ounce. Kiyosaki sees this as proof of silver’s growing importance in a world running on tech and debt.

Some Analysts See $300

Kiyosaki’s $200 target is not the most aggressive call out there. Some analysts believe silver could reach $300 in 2026.

One analysis compared silver’s price to the total U.S. money supply. By that measure, buying silver today is like buying it in 1972. For silver to match its 1980 high relative to dollars issued, it would need to hit $1,630 per ounce.

The metal also looks cheap compared to stocks. Relative to the Dow Jones, silver is trading at levels similar to the early 2000s, when it was under $6 and widely considered undervalued.

Kiyosaki Adds a Warning

Despite his confidence, Kiyosaki left room for doubt.

“As you know I could be wrong. What do you think?” he added.

Silver is volatile. Industrial demand can fall during recessions, and new supply or substitutes could appear. But with prices at record highs and momentum building, the market is paying attention.