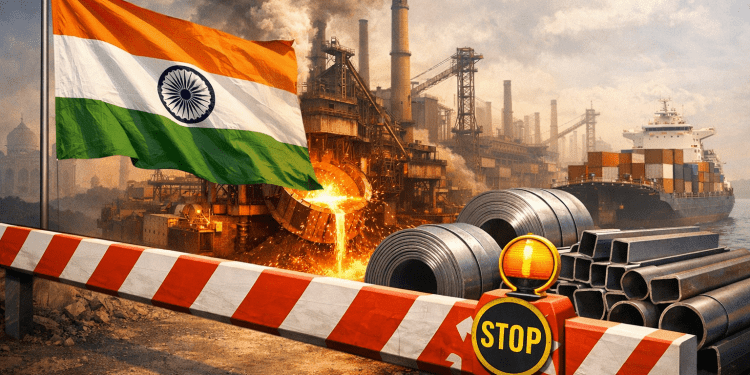

India has decided to extend its safeguard duty on certain steel imports, underlining the government’s continued push to protect local manufacturers from a prolonged wave of cheap overseas supply.

The move comes as global steel markets remain under pressure from excess output, particularly from China, which has pushed prices to multi-year lows.

For Indian mills, the decision offers breathing space at a time when domestic demand is holding up, but cheap imports have intensified.

The extension also signals that policymakers see the current trade imbalance as structural rather than temporary, warranting longer-term protection for the domestic industry.

Import levy extended

The finance ministry said on Tuesday that the safeguard duty would be extended for another three years. The levy ranges between 11% and 12% on selected steel products.

These measures were first introduced in April for a period of 200 days, aimed at providing immediate relief to domestic producers facing a sharp rise in low-priced imports.

The safeguard duty will be 12% in the first year, followed by 11.5% in the second and 11% in the third.

Imports from certain developing countries are exempted, according to the finance ministry order.

The levies will be applied to imports from China, Nepal, and Vietnam.

The order also exempts duties on specialty steel products such as stainless steel.

By extending the tariff beyond its initial term, India is effectively acknowledging that the pressures on its steel sector are unlikely to ease in the near future.

Officials have argued that without such protection, local manufacturers would continue to lose market share to cheaper imports, even as domestic consumption remains relatively strong.

Global glut pressure

India’s decision places it among a growing list of countries responding to a global steel glut.

Elevated shipments from China, the world’s largest steel producer, have flooded international markets, depressing prices and squeezing margins elsewhere.

The impact has been particularly visible in emerging economies, where domestic producers often struggle to match the pricing of Chinese exports.

In India, the surge of low-cost imports has weighed on large producers such as JSW Steel Ltd. and created severe stress for smaller mills.

Some of these smaller operators have been forced to shut down operations, despite steady demand from infrastructure, construction, and manufacturing sectors within the country.

Domestic industry stakes

India’s steel industry has expanded rapidly over the past decade, supported by government-led infrastructure spending and private investment.

Even so, the country’s total output remains only a fraction of China’s vast production capacity.

Indian producers are positioning themselves for long-term growth, banking on accelerating urbanisation and industrial expansion to drive future demand.

For these companies, the extended duty represents long-awaited relief.

Shares of Indian steelmakers rose on Wednesday after the policy announcement.

State-owned Steel Authority of India Ltd. gained as much as 4.98%, while Tata Steel Ltd. advanced up to 3.2%.

JSW Steel recorded the strongest move, rallying more than 5% during the session.

The post India extends steel import tariffs to shield domestic producers appeared first on Invezz