Global markets and politics are colliding as power, technology, and capital flow come under renewed strain.

In the United States, escalating federal threats over civil unrest raise constitutional stakes, while automakers confront hard realities about the pace of electrification.

In Asia, blockbuster semiconductor earnings underscore AI’s economic pull even as geopolitics loom large.

Meanwhile, a pivotal Indian tax ruling could redefine the rules for foreign investors navigating one of the world’s fastest-growing markets.

Trump threatens to deploy troops in Minnesota over ICE protests

US President Trump has threatened to invoke the Insurrection Act against Minnesota, escalating federal-state tensions over governance disputes.

The threat represents an extraordinary assertion of executive power, raising constitutional alarms among legal scholars and state officials.

Minnesota’s Democratic leadership has pushed back forcefully, labeling the move a dangerous overreach that undermines federalism principles.

Constitutional experts warn that such an invocation could trigger prolonged court battles and set a precedent for unprecedented executive intervention.

The standoff reflects deepening political polarization and power struggles between Washington and state governments.

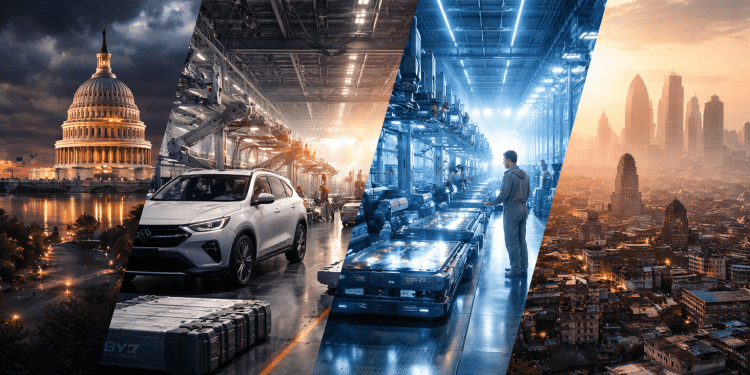

Ford-BYD pivot towards hybrids

Ford’s negotiations with Chinese battery giant BYD signal Detroit’s strategic pivot toward hybrids as EV demand crumbles.

The automaker, which took a staggering $19.5 billion EV charge last month, is exploring importing BYD batteries for hybrid models produced outside the United States.

This partnership would tap BYD’s dominance, as the company controls roughly 55% of global EV battery production alongside CATL.

Ford’s hybrid sales surged 18% year-over-year in Q4 2025, hitting 55,000 units, underscoring market realities.

While negotiations remain preliminary with no guarantees, the deal reflects industry-wide recognition that battery-electric vehicles aren’t delivering profits.

BYD’s proven cost advantages and technology could give Ford competitive breathing room in the lucrative hybrid segment.

TSMC’s blockbuster Q4 earnings

Taiwan Semiconductor Manufacturing Company has posted record fourth-quarter profits, driven by insatiable artificial intelligence chip demand that’s reshaping the semiconductor industry.

TSMC’s market valuation has surged past NT$1 trillion, reflecting investor confidence in sustained AI-driven growth.

The chipmaker’s advanced manufacturing capacity remains the bottleneck for global AI development, with major tech companies competing fiercely for production slots.

Profit margins expanded significantly as AI customers accept premium pricing for cutting-edge nodes.

Geopolitical tensions around Taiwan add volatility to TSMC’s outlook, yet demand fundamentals remain robust.

Analysts project continued momentum through 2026, though supply constraints could eventually cap growth potential.

India’s tax court weighs in on Tiger Global-Walmart deal

An Indian court is set to rule on Tiger Global’s controversial 2018 Walmart transaction, potentially reshaping how the nation handles foreign investment taxation.

The case centers on whether Tiger Global’s exit from Flipkart through Walmart’s 2018 acquisition triggered taxable gains under Indian law.

The landmark decision could establish precedent for how New Delhi treats foreign venture capital exits and cross-border M&A transactions.

Tax authorities had previously challenged the deal’s valuation methodology.

A ruling favoring India’s tax position could expose other foreign investors to retroactive assessments.

The judgment carries implications beyond Tiger Global, affecting venture capital confidence in India’s investment ecosystem and regulatory predictability.

The post Evening digest: Trump’s troop threat, Ford–BYD talks, TSMC’s Q4 earnings appeared first on Invezz